In other words, algorithms that only provide little benefit were not selected. Second, GAs have to show significant progress compared with the previous algorithms. First, GAs must be specifically designed for solving the 0-1 MKP. The selected GAs had to meet two selection criteria. For this purpose, we provide a systematic evaluation of 11 carefully chosen genetic algorithms using all 270 standard-problems by Chu & Beasley (1997, 1998) publicly available (Beasley, 1998). Consequently, one must be cautious to select the “best” GA (Chu & Beasley, 1998). A combination of multiple such studies, however, is not possible due to diverging equipment characteristics, databases, and parameter settings. Not sure if StockMarketEye, or Stockalyze is the better choice for your needs No problem Check Capterra’s comparison, take a look at features, product details, pricing, and read verified user reviews. Typically, the algorithms are contrasted to a very limited set of other alternative approaches (Hoff et al., 1996 Raidl, 1998 Gottlieb, 2000 Levenhagen et al., 2001). Rather than objective evaluations of the GAs in homogenous conditions, single approaches are primarily analyzed in the context of a new GA’s exposure.

#Review and comparison stockmarketeye software

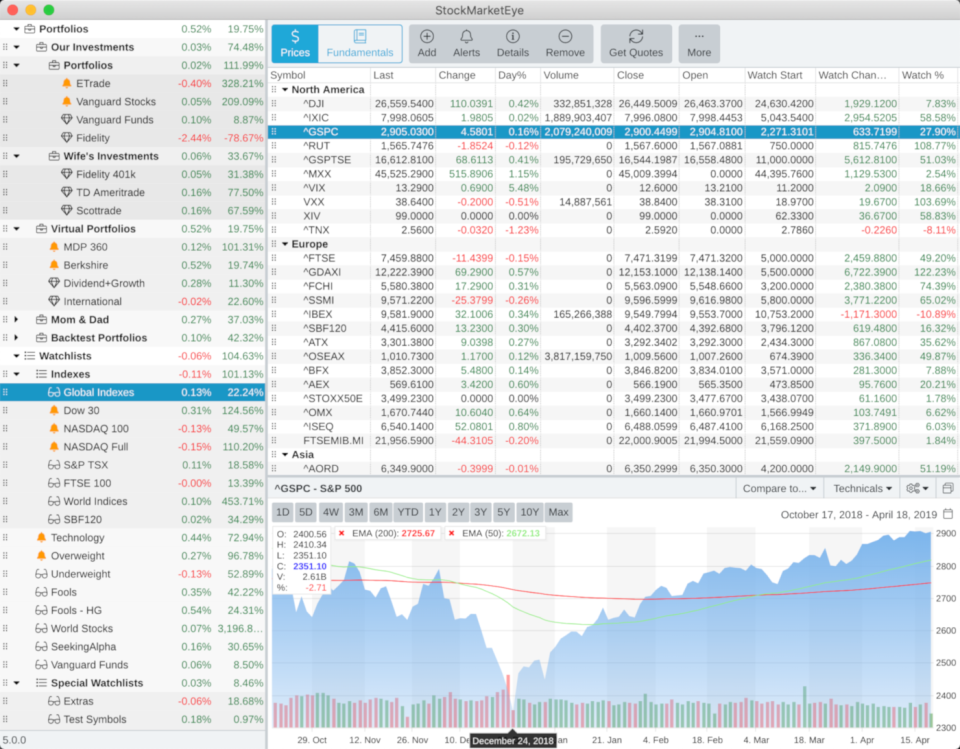

Compare price, features, and reviews of the software side-by-side to make the best choice for. Even though multiple individual GAs have been discussed in literature, a direct validation of the proposed algorithms’ efficiencies has only sparsely been performed by Raidl & Gottlieb (2005). StockMarketEye using this comparison chart. Therefore, this article focuses on the performance of genetic algorithms.Īpart from general parameters such as the population size or the crossover rate, a GA’s effectiveness and efficiency are dependent on its design. Pal & Chakraborti, 2013) and knapsack problems (cf. Raidl, 1998, 1999) and are often applied for solving various types of general optimization problems (cf. In particular, genetic algorithms (GA) have been very well suited for solving these 0-1 MKPs (cf. Drexl, 1988), or genetic algorithms are competitive alternatives, especially at such large problems (Fréville, 2004). Compare the similarities and differences between software options with real user reviews focused on features, ease of use, customer service, and value for money. Dammeyer & Voss, 1991 Hanafi & Freville, 1998), simulated annealing (cf. Foundersuite vs StockMarketEye Foundersuite has 101 reviews and a rating of 4.67 / 5 stars vs StockMarketEye which has 81 reviews and a rating of 4.52 / 5 stars. Hillier, 1969), or metaheuristics such as tabu search (cf. Senju & Toyoda, 1968), mathematical programming, (cf. Martello et al., 1999, 2000) have made improvements, large problems with an increased number of constraints remain a challenge. Two general approaches on solving the 0-1 MKP have emerged during the past decades: exact methods and heuristics. You can enter any type of transaction from buys and sells to dividends, splits, cash deposits and more.The 0-1 MKP is one of the best known integer programming problem. You can also manually add your investments using StockMarketEye's optimized data-entry windows. StockMarketEye supports importing from QIF, OFX/QFX or CSV formatted files.

The direct connect to your brokerage account makes keeping your StockMarketEye portfolio up-to-date a piece of cake.īesides the brokerage import, you can import data from files that are in one of the standard investment formats. You can import your accounts directly from most major US brokerages. Getting started is quick and easy when you use the brokerage import. StockMarketEye portfolios can track your actual investment accounts or they can be virtual portfolios that you use for fun and testing. You can generate a detailed return report based on an specific time frame you want on one portfolio or a combination of portfolios. StockMarketEye is the only program that provides a comprehensive tracking and reporting system. See the big picture and take control of your investment decisions. Best I have found I have used many portfolio tracking software packages and online sites. Gain a better picture of your financial position. Using StockMarketEye, you can quickly review all your holdings together in one spot and

Get a Bird's-Eye View of All Your Portfolios

0 kommentar(er)

0 kommentar(er)